In today’s dynamic business environment, strategic financial planning is essential for long-term success. With increasing complexities in personal finance, businesses and high-net-worth individuals in Qatar need comprehensive wealth management services to protect and grow wealth.

Qatar’s tax-free environment, coupled with political stability and economic prosperity, makes it an attractive jurisdiction for wealth accumulation and preservation. Finsoul Network offers expert wealth management services in Qatar, providing solutions to help clients achieve financial stability.

Our services ensure financial growth and protection, addressing unique needs through personalized strategies. Leading banks in Qatar, such as QNB, QIB, HSBC, and Doha Bank, offer extensive wealth management, private banking, and investment advisory services, including Sharia-compliant options and digital platforms.

Finsoul Network delivers designed approaches to handle the evolving market environment, focusing on optimizing strategies for individuals and businesses.

Quick Navigation

Scope of Our Wealth Management Services in Qatar

Industries We Serve

- High-Net-Worth Individuals (HNWIs): Personalized wealth planning for High Net Worth Wealth Qatar and investment solutions to preserve and grow individual and family wealth.

- Family Offices: Comprehensive asset and legacy management supporting intergenerational wealth transfer and philanthropic goals.

- Financial Services Sector: Offering complex investment portfolios and advisory services aligned with regulatory frameworks and market trends.

- Real Estate Investors: Strategic advisory and portfolio management for property investments to maximize returns and manage risks.

- Energy & Utilities: Wealth management designed to stakeholders in Qatar’s key natural resources sector, optimizing returns from energy investments.

- Technology Sector Investors: Managing portfolios with focus on emerging tech assets and innovation-driven opportunities.

- Government & Public Sector Entities: Advising on sovereign wealth and public fund management to support economic stability and strategic growth.

- Healthcare & Pharmaceuticals: Providing investment advisory aligned with sector growth and compliance dynamics.

- Entrepreneurs & SMEs: designed financial guidance to support business growth and diversification of assets.

Relevant Laws, Standards, Or Industry Frameworks

Qatar Financial Centre (QFC) Laws

Provides a regulatory framework for financial services in Qatar.

Qatar’s Investment Law

Governs investment activities and wealth management protocols.

FATF (Financial Action Task Force)

Sets global standards for preventing financial crimes and fraud.

Islamic Finance Laws (Sharia)

Ensures compliance with Islamic financial principles in wealth management.

Anti-Money Laundering (AML) Law

Establishes measures and controls to prevent money laundering and terrorist financing in Qatar.

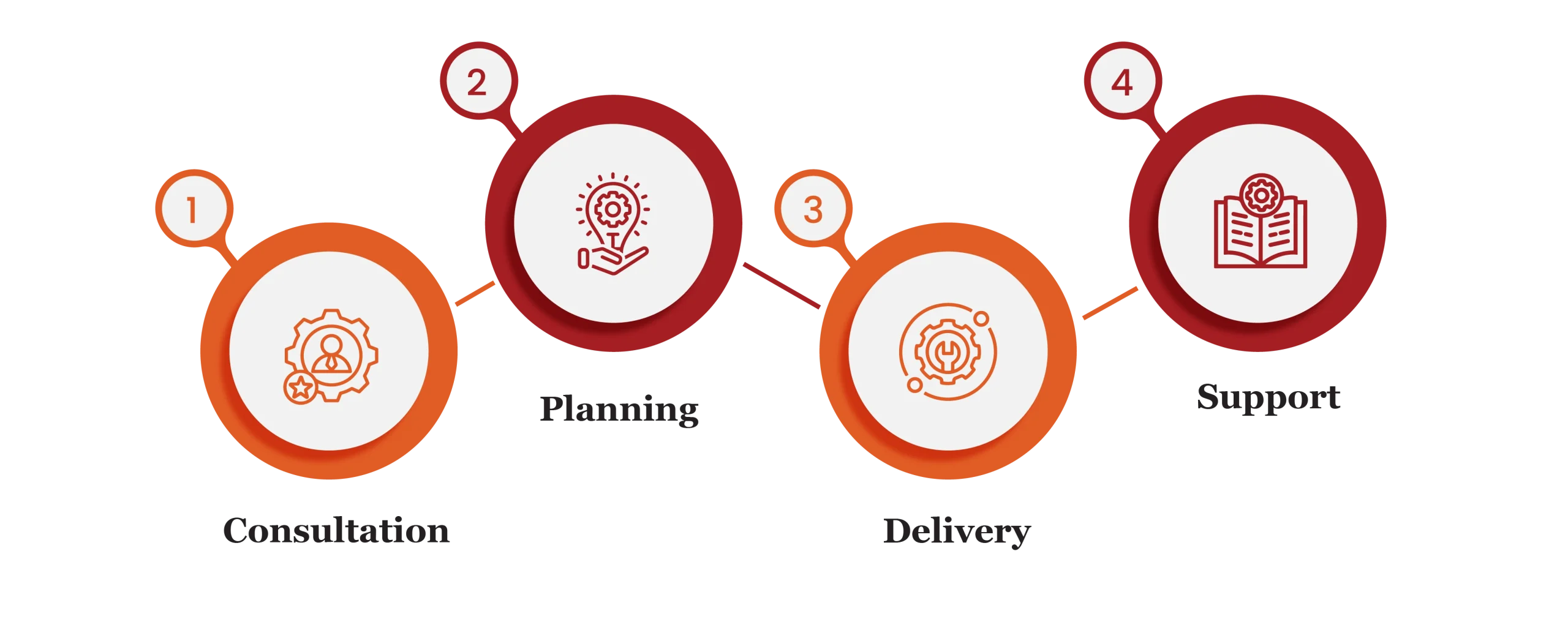

Our Proven Process of Personal Wealth Management in Qatar

Finsoul Network Qatar employs a personalized, phased approach to delivering wealth management services in Qatar:

- Consultation: Understand client goals, financial situation, and risk appetite.

- Planning: Develop a tailored strategy for financial planning, investment advisory in Qatar, and wealth portfolio management in Qatar.

- Delivery: Implement the strategy with expert advice and ongoing management.

- Support: Continuous monitoring and adjustments to ensure optimal outcomes, ensuring compliance with local laws and global standards.

Our approach is scalable to meet the evolving needs of our clients, ensuring long-term wealth preservation and growth.

Estimated Timelines of Our Wealth Management Services in Qatar

Timelines may vary based on the complexity and scope of financial and regulatory requirements. We ensure thorough assessments and implementation support aligned with Qatar’s evolving legal environment to maintain timely compliance and risk mitigation.

Why Choose Finsoul Network For Wealth Management Services in Qatar?

We offers unparalleled expertise in wealth management services, supported by industry certifications and a commitment to personalized, client-focused strategies. Our team provides responsive support and in-depth financial analysis to ensure that your wealth grows securely and efficiently.

We focus on compliance, risk reduction, and delivering real, measurable results that align with your financial goals. Our private wealth management in Qatar services are designed to your specific needs, ensuring you stay competitive, secure, and legally compliant.

Choose us for expert retirement and wealth planning solutions built around your unique financial needs and long-term objectives. Our dedicated team delivers personalized asset management and wealth advisory services, ensuring your wealth is strategically managed and your retirement goals are within reach.

Schedule a Consultation with Our Expert Team

Ready to move forward? Booking an appointment with our expert team is quick and easy. Whether you need a consultation, assistance with our services, or want to explore partnership opportunities, we are here to guide you every step of the way. Our dedicated team ensures a seamless experience, providing expert advice and tailored solutions to meet your needs. Schedule your appointment today and take the next step with confidence!

FAQ's: