Loan brokers services in Qatar play an essential role in simplifying access to finance for individuals and businesses, supporting Qatar’s fast-growing economy. Effective brokerage services help clients secure suitable financing by evaluating multiple lending options and managing complex loan processes efficiently.

Personal loan brokers assist in obtaining customized personal financing solutions while business loan brokers focus on securing capital for small business loan requirements and expansion efforts. Finsoul Network Qatar delivers expert guidance in this domain, ensuring legal compliance.

With competitive loan terms, and smooth transaction processes, these services are vital in Qatar’s dynamic financial environment to promote financial inclusion, support business growth, and empower individuals with affordable credit solutions aligned with market demands.

Quick Navigation

Scope Of Our Loan Brokers services In Qatar

Industries We Serve

- Residential Real Estate: Assisting individuals and families in securing mortgage loans with favorable terms and streamlined approval processes.

- Commercial Real Estate: Supporting businesses and investors through expert real estate brokerage, helping them obtain financing and identify the best office, retail, and industrial property opportunities.

- Real Estate Development: Facilitating construction and development financing aligned with project timelines and budgets.

- Financial Services: Advising financial institutions and investment firms on loan products and portfolio financing solutions.

- Government and Public Sector: Assisting public entities with financing solutions designed to housing policies and infrastructure projects.

- Small and Medium Enterprises (SMEs): Providing access to working capital and small business loan to support growth and operational needs.

Relevant Laws, Standards, Or Industry Frameworks

Sets maximum loan-to-value (LTV) ratios, tenure limits, and debt burden caps for residential and commercial mortgages.

Real Estate Registration Law (Law No. 6 of 2014)

Regulates property transactions, ownership rights, and registration procedures in Qatar to enhance transparency and legal certainty.

Anti-Money Laundering Law (Law No. 20 of 2019)

Prevents financial crimes in property financing and transactions through stringent compliance obligations.

Islamic Banking Regulations

Governs Sharia-compliant financing products commonly used in property loans, ensuring compliance with Islamic finance principles.

Central Bank Lending Limit Framework

Defines debt-to-income ratios and overall lending limits to protect borrowers and maintain financial sector stability.

Real Estate Development Escrow Account Regulation (Circular 2-2025)

Oversees the management and protection of funds for real estate development projects.

Process Of Delivering Loan Brokers Process In Qatar

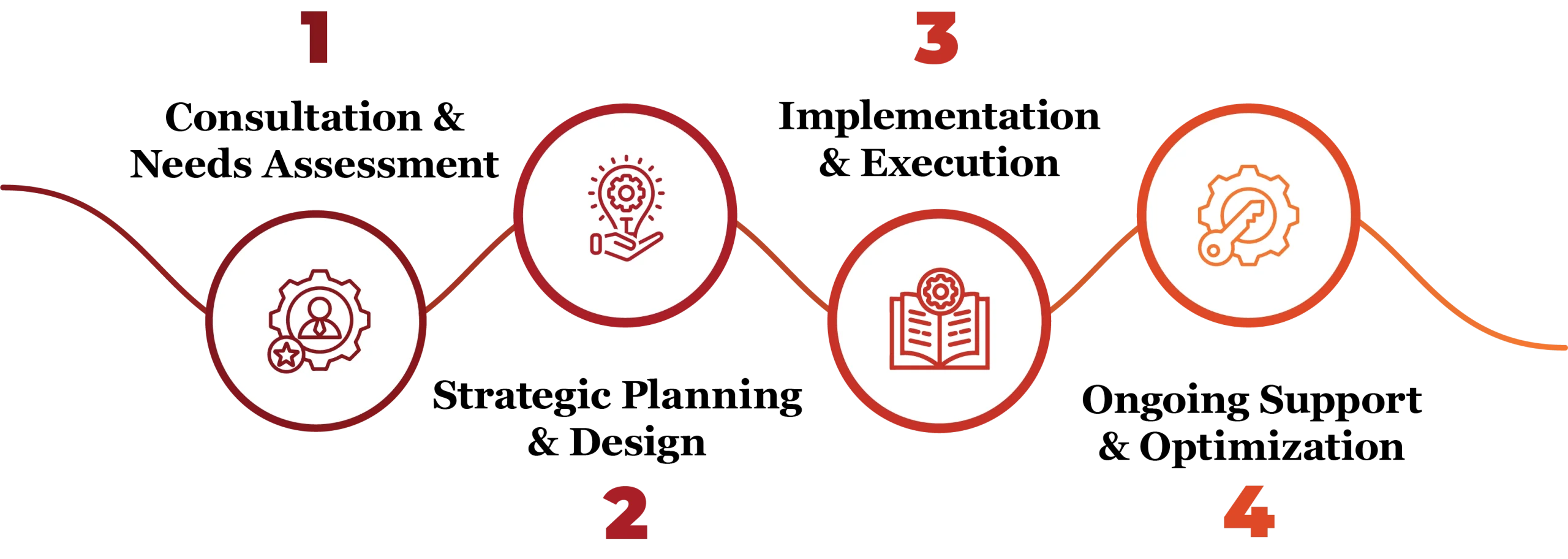

Finsoul Network delivers personalized, scalable processes to ensure secure loan options and compliance for every unique client need.

- Consultation & Needs Assessment: Loan brokers services in Qatar start with detailed consultations, analyzing clients’ financial goals, credit profiles, and documentation to define clear, individual requirements.

- Strategic Planning & Design: We design suitable loan strategies, recommending the most relevant products, lenders, and repayment terms designed to your unique financial objectives and risk tolerance.

- Implementation & Execution: coordinate the full application process submitting documents, negotiating with lenders, and ensuring regulatory compliance for seamless and transparent approvals.

- Ongoing Support & Optimization: Ongoing advisory maximizes benefit, offering support for refinancing, regulatory changes, and new financial opportunities as your needs evolve.

Project Timelines For Loan Brokers services In Qatar

Timelines for loan consulting and home loan brokers typically range from 5 to 20 business days, depending on the loan type and documentation completeness. Our loan consultants and independent loan brokers ensure swift application processing and approval, while bank loan assistance provides expert support throughout to secure favorable financing terms efficiently.

Why Choose Finsoul Network For Loan Brokers Services In Qatar?

Finsoul Network Qatar is a leading provider of loan brokers services in Qatar, with a team of experienced professionals dedicated to securing the best loan options for clients. We take a personalized approach, ensuring that each solution is designed to meet your specific needs. Our expert team is responsive, and we pride ourselves on offering guidance that reduces risk and ensures compliance with all relevant laws.

With our deep industry knowledge and commitment to client support, Finsoul Network stands out as a reliable partner in securing personal and business financing. Our unique approach focuses on both efficiency and customer satisfaction, making us the go-to choice for loan advisory services.

Schedule a Consultation with Our Expert Team

Ready to move forward? Booking an appointment with our expert team is quick and easy. Whether you need a consultation, assistance with our services, or want to explore partnership opportunities, we are here to guide you every step of the way. Our dedicated team ensures a seamless experience, providing expert advice and tailored solutions to meet your needs. Schedule your appointment today and take the next step with confidence!

FAQ's: